We earn a commission for products purchased through some links in this article.

How To Save Money On A Budget: From The Latest Apps To Saving Goals

Here's how to save some extra cash this month and every month

Money has always been a complicated subject, but in recent years the conversation around it, how we spend it and how to save money have been opening up, with a lot more transparency around pay, budgeting and saving.

Millennials have long been branded 'Generation Broke' – people in their twenties and thirties struggling to get by with rising transport, housing and food costs, coupled with the desire to fulfil their dreams, set up their own business and still enjoy life. And it's no surprise given that the average salary of a millennial is approximately 20% lower than the average salary that a Baby Boomer had at the same age, according to personal finance technology company Smart Asset.

Even the lucky people who are earning good money are still suffering from crippling debts and student loan paybacks. According to research by Experian, millennials increased their average credit card debt by seven per cent in the last year, due to more financial considerations such as larger student loans. According to the BBC, students who took a three year degree course from 2012 onwards, will be in around £50,000 of student debt.

At the moment, it seems like there's little chance of financial improvement coming our way anytime soon. The solution? Take action by setting simple yet realistic money saving goals and use apps to help you save each month.

Here's how to save money according to financial experts and the ELLE team:

Watch Next

A 'Baby Reindeer' Second Season Is On The Cards

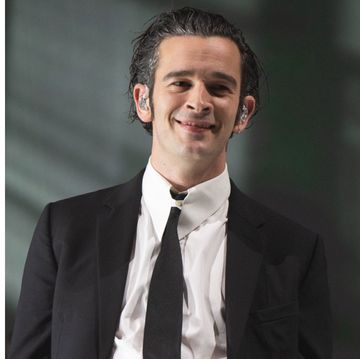

Matty Healy Just Shared His Thoughts On 'TTPD'

Bella Hadid Sends Birthday Love to Sister Gigi

Taylor And Gigi Have Been Double Dating